Income tax planning and its benefits | Introduction to Tax Planning is an intellectual process that makes

Therefore,

your financial position more tax efficient. This applies to all actions taken by taxpayers to ensure that

In other words, their tax liabilities are minimized and all available deductions, credits and exemptions are used and function in a coordinated manner. It is therefore a process that analyzes one’s financial position in terms of tax efficiency.

However,

As a taxpayer, you can have several sources of income:

Household income,

Wage,

Income from a business or profession,

Capital gains

Income from other sources.

For instance, Regardless of your source of income, you have to pay taxes to the government at the paved rates. Therefore, a central element of a good tax plan is to reduce the tax burden and increase savings while complying with legal obligations.

Download and prepare One by One Form 16 Part B for the Financial Year 2021-22

Why choose tax planning?

Tax planning is an integral part of your business and you are suffering losses if you don’t make the best use of the deductions and benefits provided by the state. It helps achieve business and financial goals and offers various benefits to both large and small businesses.

Above all,

Taxes will have a major impact on your income, so a tax plan is important for managing your wealth. In today’s fast-paced environment, it’s important to keep up with changes in tax legislation and have strategic plans to make sure you are paying exactly what you owe.

The benefits of tax planning

Tax breaks, deductions and discounts can be requested if you know the taxes in detail. It also ensures that you plan your expenses well and save more.

In addition,

Download and prepare at a time 50 Employees Form 16 Part B for the Financial Year 2021-22

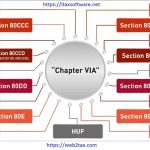

After that, Deductions for different sections

U/s 80C Deduction – Provides some of the most useful options for minimizing your tax payment rate. You can get a tax relief of up to Rs 150,000. Life insurance expenses, employee reserve fund contributions, college fees, mortgage repayments, all can be claimed under 80C.

U/ s 80D deductions: if the insurance premium is paid for health or medical insurance of you, spouse, children and parents, the maximum deduction is Rs 25,000 for children under 60 and Rs 50,000 for those over 60. allowed.

Deductions u / s 80DD: Deductions of up to Rs 75,000 or Rs 1.25,000, as applicable, are provided to an employee for expenses incurred in treating and maintaining his disabled employee.

U / s 80E deductions: Interest paid on a student loan in a fiscal year is eligible for u / s 80E deduction.

U / s deductions 80TTA and 80TTB: This is the simplest deduction an individual can request, as long as the taxpayer has money in a savings account. Interest earned on savings accounts is tax-free up to Rs 10,000 at 80 TTA and up to Rs 50,000 for seniors at 80 TTB.

Deductions U/ s 80U: taxpayers are eligible for deductions of up to Rs 1.25,000 if they suffer from certain disabilities or illnesses.

Download and prepare at a time 100 Employees Form 16 Part B for the Financial Year 2021-22