Tax Exemption in different sections of Income Tax for the F.Y.2023-24 for the Old Tax Regime | A tax exemption is a benefit granted by the government to individuals or organizations to exempt some or all of their income from taxation. As per the Income Tax Act exemptions are provided under different sections in India. Including Sections 80C, 80D, 80E, 80G, and 80GG. These sections provide tax credits and deductions for certain types of investments and expenses, such as provident fund contributions, health insurance payments, interest payments on education loans, donations to charities, and rent paid by non-employees.

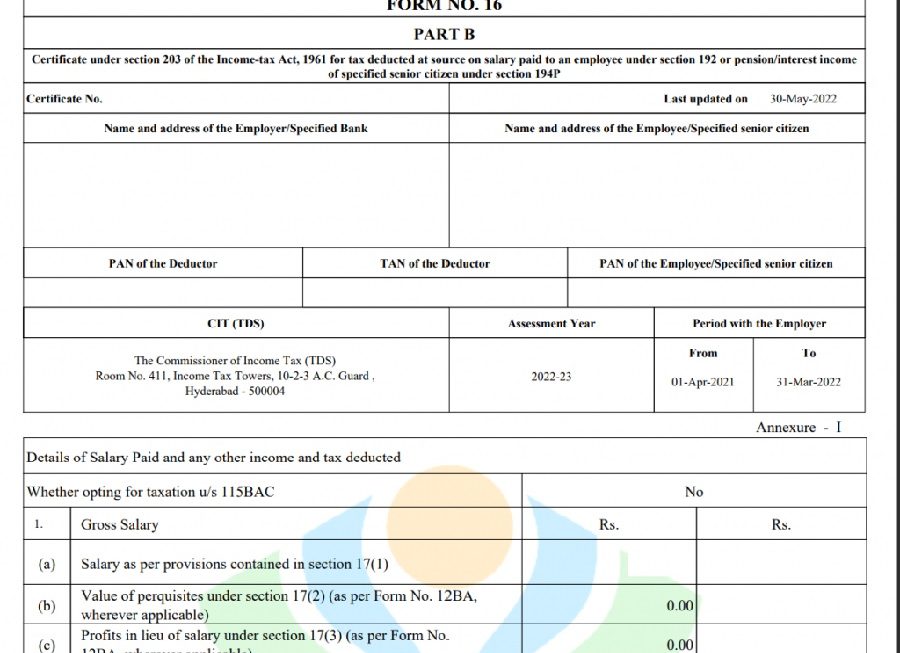

You may also like- Auto Prepare IncomeTax Master of Form 16 Part B which can prepare at a time 50 Employees in Excel for the F.Y.2022-23 and A.Y.2023-24

Therefore, A tax exemption is a benefit granted by the government that allows individuals or organizations to exclude some or all of their income from taxation. It is designed to encourage certain behavior or provide financial assistance to specific groups of taxpayers. Sectional tax credits come in many forms, including credits, credits, and exclusions from gross income, and can significantly reduce a taxpayer’s tax liability. For example, personal allowances allow individuals to claim certain amounts for themselves, their spouses, and their dependents, reducing their taxable income.

In other words, Charitable contributions to qualified organizations may be taxable, reducing taxable income. Other common tax deductions include mortgage interest, state and local taxes, education expenses, and contributions to retirement accounts. Tax credits can change and vary by country, so it’s important to seek professional advice or consult the relevant government authorities for the most up-to-date information. In general, tax credits play an important role in economic and social policy-making and are a valuable tool for managing personal and organizational finances.

You may also like- Auto Prepare Income Tax Master of Form 16 Part A&B which can prepare at a time 50 Employees in Excel for the F.Y.2022-23 and A.Y.2023-24

TDS 2023 deductions

However, TDS stands for withholding tax, and TDS exemptions refer to cases where a person or organization is exempted from paying TDS on their income. In India, TDS is a means of collecting income tax by deducting tax at source from personal income.

General sections providing tax relief

Tax exemptions in India are provided under various sections of the Income Tax Act. Here are the most common sections detailing tax deductions:

For instance,

Section 80C: This section provides special deductions for investment and expenditure and tax deductions for investment. Some common deductions under Section 80C include Public Pension Fund (PPF), Employees Provident Fund (EPF), National Savings Certificate (NSC), and life insurance contributions. The maximum amount that can be claimed as a deduction under section 80C is Rs 1.5 lakh per tax year.

You may also like- Auto Prepare IncomeTax Master of Form 16 Part B which can prepare at a time 100 Employees in Excel for the F.Y.2022-23 and A.Y.2023-24

Section 80D: Above all, This section provides tax deductions for health insurance premiums. Claim a deduction Maximum of Rs 25,000 per financial year on health insurance premiums for themselves, their spouses, and dependent children and an additional deduction of up to Rs 25,000 per tax year for senior citizen health insurance premiums.

In addition, Section 80E: This section provides tax deductions for interest payments on education loans. Taxpayers can claim all interest paid on education loans, unlimited, for up to 8 financial years.

Section 80G: After that, This section provides tax deductions for donations made to specific charities and relief funds. Donors can claim a reduction of up to 100% or 50% of the donation amount, depending on the organization.

You may also like- Auto Prepare Income Tax Master of Form 16 Part A&B which can prepare at a time 100 Employees in Excel for the F.Y.2022-23 and A.Y.2023-24

Similarly, Section 80GG: This section provides tax relief on rent paid by individuals who do not receive HRA (House Rent) from their employer. Taxpayers can claim a deduction of up to Rs 60,000 per tax year for rent paid under certain conditions.

In conclusion, It should be noted that the tax deductions under these sections may vary and may vary depending on the individual circumstances of the taxpayer. It is best to consult a tax professional or the Indian Income Tax Department for the most up-to-date information on tax exemptions in India.

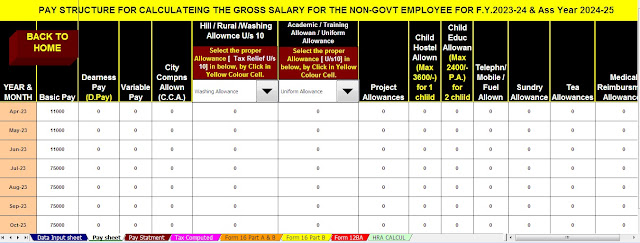

Download Automated Income Tax Preparation Excel-Based SoftwareAll in One for the Non-Government (Private) Employees for the F.Y.2023-24 and A.Y.2024-25

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Non-Government Employees Salary Structure.

4) Automated Income Tax Form 12 BA

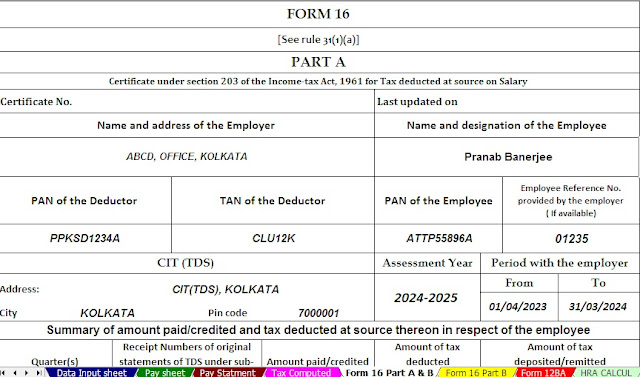

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24