Income tax deduction under Sec 80 CCD (1B). According to the rules and regulations of the Income Tax Act 1961, payment of income tax is mandatory for every citizen of India. But that doesn’t mean you have to pay tax on the income you make. In a given financial year. Therefore, there are several provisions under the Income Tax Act that […]

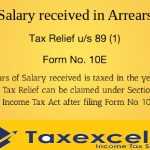

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E from the F.Y.2000-01 to F.Y.2021-22 and Tax Benefits on Home Loans: Sections 24, 80EEA and 80C

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E. There are 2 components to a home loan repayment such as principal repayment and interest repayment. Since there are 2 different components to debt repayment, the tax benefits of a home loan are regulated by different sections of the Income Tax Act and are claimed as tax […]

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22 with details of Section 80TTA of the Income Tax Act

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22 with details of Section 80TTA of the Income Tax Act As per the Income Tax Act Under Section 80TTA provides for an Exemption for interest income from Bank/Post Office. Discounts are available with a few limitations and limitations. In this […]

Download Auto-fill Income Tax Preparation Software All in One in Excel for the Govt and Private Employees for the F.Y.2021-22 with Section 80C – Deduction on Investment

Download Auto-fill Income Tax Preparation Software All in One in Excel for the Govt and Private Employees. Section 80C is the most preferred category of all income taxpayers because it allows the taxpayer to reduce tax liability by making tax-saving investments and collecting eligible expenses. This allows a maximum of Rs 1,50,000 per year to be deducted from […]

Automated Income Tax Preparation Software in Excel for the All Govt and All Non-Govt Employees for the F.Y.2021-22 with details of deduction under chapter VI A

Automated Income Tax Preparation Software in Excel for the All Govt and All Non-Govt Employees Taxpayers are entitled to get the benefit of tax deduction U/s 80C as per the Income Tax Act for a LIC policy, fixed deposit, superannuation / PF, tuition fee. Taxes are an integral part of our country, accounting for a large portion […]

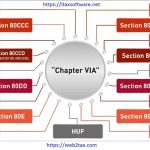

Download Excel based tax preparation software for Assam, Bihar, Andhra Pradesh, West Bengal, Jharkhand government. Employees of F.Y.2021-22 including Chapter VI-A of the Income Tax Act

Download Excel based tax preparation software. Chapter VI of the Income-tax Act contains various sub-sections of section 80 which allow an assessor to claim deduction from the total income due to various tax-savings investments, approved expenditures, grants, etc. Payable. Chapter VI A of the Income-tax Act contains the following sections: 80C: Deduction in case of subscription of life […]

Download Auto-fill Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E for F.Y. 2021-22 and details of U/s 80TTA

Download Auto-fill Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E for F.Y. 2021-22 and details of U/s 80TTA What is Section 80TTA? Section 80TTA of the Income Tax Act provides a rebate for interest income. Discounts are available with some limitations and restrictions. In this article, we have covered everything related to claiming tax […]

Download Auto-fill Income Tax Preparation Software All in One in Excel for the Govt and Private Employees for the F.Y.2021-22 with Section 80C – Deduction on Investment

Download Auto-fill Income Tax Preparation Software All in One in Excel for the Govt and Private Employees .Section 80C is the most preferred category of all income tax payers because it allows the taxpayer to reduce tax liability by making tax saving investments and collecting eligible expenses. This allows a maximum of Rs 1,50,000 per year to be […]

Download Auto-fill Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E for F.Y. 2021-22 and details of U/s 80TTA

Download Auto-fill Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E for F.Y. 2021-22 and details of U/s 80TTA What is Section 80TTA? Section 80TTA of the Income Tax Act provides a rebate for interest income. Discounts are available with some limitations and restrictions. In this article, we have covered everything related to claiming tax […]